If you’re responsible for hiring or security decisions, you’ve probably noticed that identity verification has gotten complicated. We’re not just checking IDs anymore. AI-powered systems now analyze images in ways that go far beyond simple matching, and understanding the difference between verification and analysis isn’t just technical minutiae. It’s the difference between confirming someone’s identity and making judgments about them based on their photo.

The stakes are real. According to recent NIST guidelines, face morphing software can blend two people’s photos into one image, making it possible for someone to fool identity checks. Meanwhile, organizations are using increasingly sophisticated analysis tools that extract far more information from images than most people realize.

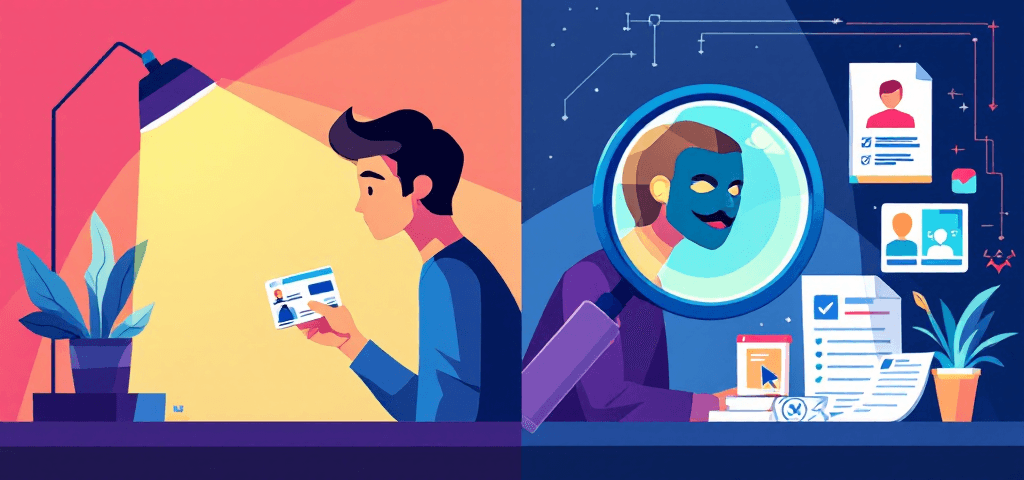

Here’s what you need to understand: verification confirms that a person is who they claim to be through one-to-one matching. Analysis and evaluation extract additional insights from images, assess document authenticity, detect manipulation, and sometimes make risk assessments. They’re fundamentally different processes with different privacy implications, compliance requirements, and fraud prevention capabilities.

Image Verification: The Foundation of Identity Confirmation

Verification is straightforward in concept. You’re comparing two images to confirm they show the same person. When a candidate submits their driver’s license during remote hiring, your system compares that photo to a live selfie they take. That’s verification.

The Department of Homeland Security describes this as “one-to-one” matching, where facial features from one image are compared against another specific image to confirm a match. It’s binary: either the person in photo A is the same person in photo B, or they’re not.

Most verification systems use biometric comparison algorithms that measure distances between facial features. These AI models have gotten remarkably accurate, but they’re not perfect. Image quality matters enormously. Poor lighting, low resolution, or unusual angles can all affect accuracy.

Common Verification Scenarios in Hiring

You’ll typically use verification when onboarding remote employees, confirming candidate identity before interviews, or managing access control for facilities. The goal is simple: make sure the person showing up (physically or virtually) is actually the person you hired.

But verification has limitations. It can’t tell you if a document is forged. It can’t detect if someone used morphing software to create a hybrid image. And it definitely can’t assess whether someone is suitable for a role. That’s where analysis comes in.

The Morphing Problem Nobody Talks About

Face morphing is probably the most sophisticated fraud technique targeting verification systems right now. Software can blend two people’s facial features so seamlessly that the resulting image will verify against both individuals. Someone could theoretically use a morphed passport photo to pass through identity checks, then have an accomplice use the same document.

NIST released guidelines in 2025 specifically addressing this threat. Their research shows that standard verification systems often can’t detect morphed images without additional analysis capabilities. This is why many organizations are moving beyond simple verification.

Image Analysis and Evaluation: Going Deeper

Analysis is where things get interesting and complicated. Instead of just matching faces, analysis systems examine images for authenticity, manipulation, and additional information. They’re looking at metadata, checking for signs of digital alteration, analyzing document security features, and sometimes extracting patterns across multiple images.

Think of it this way: verification asks “Is this the same person?” Analysis asks “Is this image real? Has it been manipulated? What else can we learn from it?”

AI-powered analysis tools can detect deepfakes, identify morphed images, verify document authenticity, and spot patterns that might indicate fraud. Some systems analyze pixel-level inconsistencies that humans would never notice. Others check whether metadata matches the claimed image source.

When Analysis Makes Sense for Recruiting

You probably don’t need sophisticated analysis for every hire. But for security-sensitive positions, roles requiring clearances, or situations where you’ve seen fraud attempts, analysis adds a crucial layer of protection.

Document forensics can verify that a credential is genuine, not just that the photo matches. Pattern recognition across your hiring database might reveal that multiple applications used suspiciously similar photos or documents. These capabilities go way beyond what verification alone can accomplish.

The Evaluation Layer and Its Risks

Here’s where things get ethically murky. Some systems don’t just analyze images for authenticity. They evaluate them to make hiring or security decisions. This might include assessing “trustworthiness” from facial features, analyzing expressions, or making predictions about behavior.

Be extremely careful here. Many of these evaluation techniques lack scientific validity and can perpetuate bias. Just because AI can extract patterns from images doesn’t mean those patterns are meaningful or fair. Using facial analysis to assess personality traits or job suitability is legally risky and ethically questionable in most contexts.

Key Differences That Impact Your Decision

Aspect | Verification | Analysis/Evaluation |

|---|---|---|

Primary Purpose | Confirm identity match | Detect fraud, assess authenticity, extract insights |

Technical Process | One-to-one biometric comparison | Multi-factor analysis, forensics, pattern recognition |

Data Retention | Minimal, often temporary | May require extended storage for pattern analysis |

Privacy Risk | Moderate (biometric data) | Higher (additional data extraction and processing) |

Fraud Detection | Identity substitution | Morphing, deepfakes, document forgery, pattern fraud |

Typical Speed | Near-instant | Varies, can be slower for deep analysis |

The compliance implications differ significantly too. Verification typically requires clear consent for biometric processing under laws like GDPR and various state biometric privacy laws. Analysis often triggers additional requirements because you’re processing more data and potentially making more consequential decisions.

From a cost perspective, verification systems are generally less expensive to implement and maintain. Analysis requires more sophisticated AI models, greater computing resources, and often ongoing updates to detect new fraud techniques.

How AI Changes Both Processes

AI has transformed both verification and analysis, but in different ways. For verification, machine learning improves matching accuracy and helps systems handle variations in lighting, angles, and aging. Modern AI can verify identity even when someone’s appearance has changed somewhat since their ID photo was taken.

For analysis, AI enables capabilities that were impossible just a few years ago. Deep learning models can detect deepfakes by identifying subtle artifacts in generated images. Computer vision can spot morphed photos by analyzing facial feature consistency. Pattern recognition can flag suspicious document patterns across thousands of applications.

The AI Accuracy Problem

But AI isn’t magic. These systems make mistakes, and those mistakes can have serious consequences. False positives might flag legitimate candidates as fraudulent. False negatives might let actual fraud slip through. And bias remains a persistent problem, with some systems showing different error rates across demographic groups.

This is why human oversight matters. AI should augment human decision-making, not replace it entirely. When a system flags something as suspicious, someone with expertise should review it. When verification fails, there should be alternative processes for legitimate candidates.

Practical Implementation Guidance

Start by honestly assessing your needs. How much fraud are you actually seeing? What’s your risk tolerance? What are your compliance obligations? For many organizations, basic verification is sufficient. You don’t need advanced analysis if you’re hiring for low-risk positions and haven’t experienced fraud attempts.

But if you’re in financial services, healthcare, government contracting, or other security-sensitive sectors, analysis capabilities might be worth the investment. The same goes if you’ve seen morphing attempts, deepfakes, or patterns of document fraud.

What to Look for in Vendors

- Clear accuracy metrics with demographic breakdowns showing fairness

- Compliance certifications relevant to your industry and jurisdiction

- Transparent explanations of what data is collected and how it’s used

- Human review processes for flagged cases

- Regular updates to address new fraud techniques

- Data retention policies that minimize privacy risk

- Integration capabilities with your existing systems

Don’t just take vendor claims at face value. Ask for evidence. Request case studies. Talk to other organizations in your industry about their experiences.

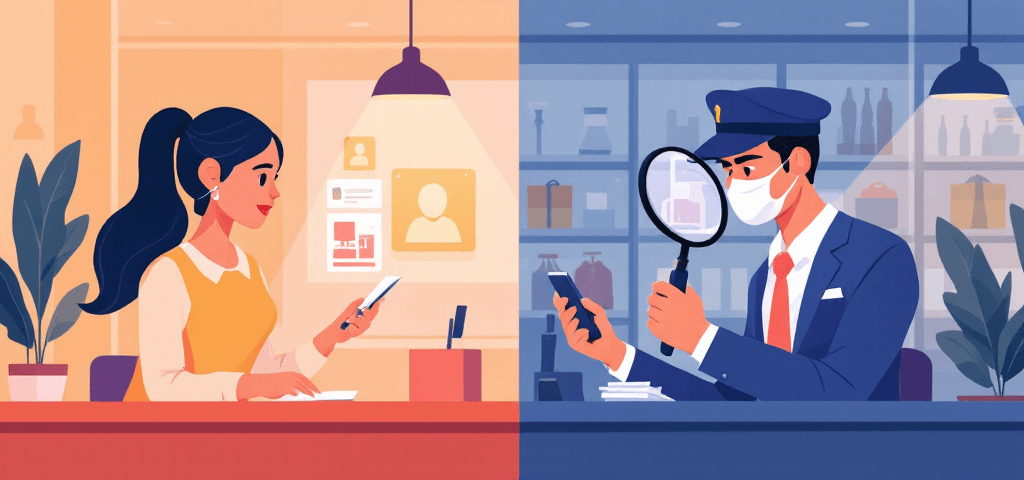

Building Compliant Systems

Privacy compliance isn’t optional. You need clear consent processes that explain what you’re doing with images. Candidates should understand whether you’re just verifying identity or conducting deeper analysis. They should know how long you’ll retain their biometric data and what rights they have.

Different jurisdictions have different requirements. Illinois’ Biometric Information Privacy Act is particularly strict. GDPR requires specific legal bases for biometric processing. Some states are considering or have passed laws restricting AI use in hiring. Stay current on regulations affecting your operations.

Making the Right Choice for Your Organization

There’s no universal answer here. The right approach depends on your specific circumstances, risk profile, and resources. But here’s a framework that might help.

Use verification alone when you’re hiring for standard positions, have low fraud risk, want to minimize privacy concerns, and need fast, cost-effective identity confirmation. It’s probably sufficient for most office jobs, retail positions, and roles without security clearance requirements.

Add analysis capabilities when you’re filling security-sensitive positions, have experienced fraud attempts, operate in highly regulated industries, or hire remotely at scale where fraud risk is higher. The additional cost and complexity are justified by the enhanced fraud detection.

Consider hybrid approaches where you use basic verification for most hires but trigger deeper analysis for high-risk scenarios. This balances cost, privacy, and security. You might analyze only when verification confidence is low, when hiring for sensitive roles, or when other risk factors are present.

Looking Ahead

Fraud techniques will keep evolving. Deepfakes are getting more sophisticated. Morphing software is becoming more accessible. AI-generated images are harder to detect. Your systems need to evolve too.

When evaluating solutions, think about scalability and adaptability. Can the system handle increased hiring volume? Will it receive updates to detect new fraud techniques? Can it integrate with future tools you might adopt?

The distinction between verification and analysis matters because they serve different purposes, carry different risks, and require different approaches to implementation and compliance. Verification confirms identity. Analysis detects fraud and extracts insights. Both have their place, but understanding which you need and when you need it is crucial for making informed decisions that protect your organization while respecting candidate privacy.

Start with your actual needs, not the fanciest technology. Build in human oversight. Stay compliant with privacy laws. And remember that these systems should support your hiring and security decisions, not make them for you.